The Inflation Reduction Act May Save the Fossil Fuel Industries

(First published in The Hill on August 14, 2022)

The Inflation Reduction Act moved through Congress quickly, passing the Senate and the House and gaining the President’s signature in less than a month — allowing for little time to understand the importance of tax credits for fossil fuel companies.

(If you are not familiar with tax credits, as a starting point you may read my report on how the existing 45Q tax credit program works.)

Why the IRA’s Amendments to the 45Q Tax Credit Program Is Inequitable, Corrupt, and Wasteful

The federal 45Q tax credit program allows participants to reduce their federal taxes based on the amount of carbon dioxide (CO2) they are able to extract from the air pollution that comes from smoke stacks. Under existing law, for each metric ton (2,204.6 pounds) of carbon captured, the existing program provides $50/metric ton if the carbon is simply pumped underground (sequestered) and $35/metric ton if the carbon is used in enhanced oil recovery operations (EOR). The use of carbon dioxide in EOR is based on the fact that liquid carbon dioxide is a very good solvent, so it can be used to dissolve oil that is trapped in rock deep underground.

The IRA would increase the 45Q program tax credits to $85/metric ton for sequestration and $60/metric ton for EOR, a 70% increase. For most people, these are just abstract numbers. But, they are very important to the U.S. Congress and their oligarch supporters, so it’s important for us to understand how this increase in tax benefits will affect our country and environment. This blog post explains the significance of the IRA’s proposed increase in 45Q tax credits.

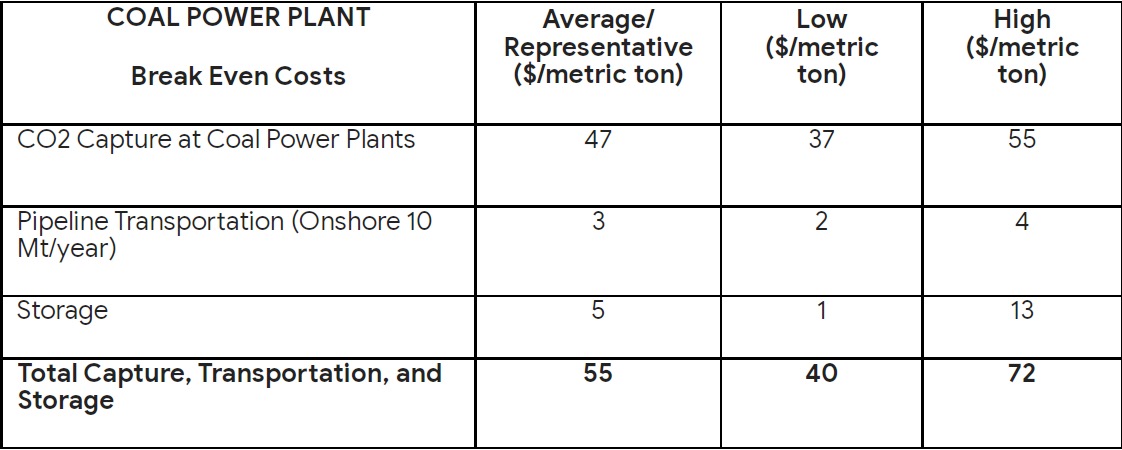

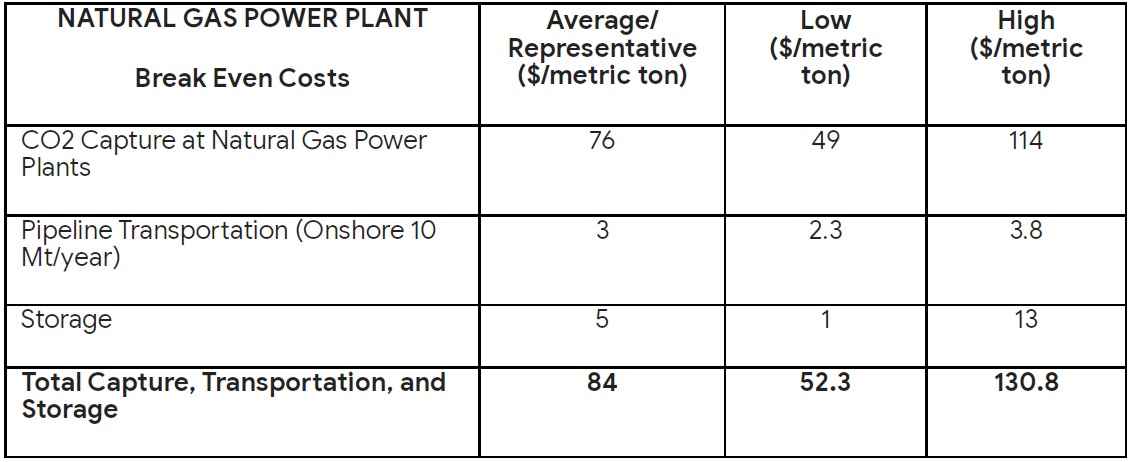

One of the most significant flaws in the 45Q program, made all the more glaring by the IRA, is that it provides fixed tax credits regardless of the cost of capturing carbon. The problem with this approach is that the costs of capturing carbon vary widely depending on industry. For example, the levelized break-even cost of carbon capture at ethanal plants is reported as $25-$35/metric ton. It may cost even less at natural gas processing plants. In contrast, the levelized break-even costs at coal power plants is reported to be in the range of $37-$55/metric ton, and at natural gas power plants $49-$114/metric ton. Yet, the 45Q program provides the exact same tax credit regardless of the actual costs of capture. The tables below show the range of estimated break-even costs needed to pay for carbon capture facilities at coal and natural gas power plants. Tax credits in excess of break-even costs can be turned into profit.

Source: Schmelz et al., Total Cost of Carbon Capture and Storage Implemented at a Regional Scale: Northeastern and Midwestern United States, The Royal Society Publishing, June 8, 2020.

Source: Schmelz et al., Total Cost of Carbon Capture and Storage Implemented at a Regional Scale: Northeastern and Midwestern United States, The Royal Society Publishing, June 8, 2020.

Even though capture at an ethanol plant might cost just $25/metric ton and transportation and sequestration costs might add $5/ton more, the owner of the capture equipment would still receive tax credits worth $85/metric ton. The 70% increase in this one-size-fits-all tax credit means that low-cost carbon capture projects will win the lottery.

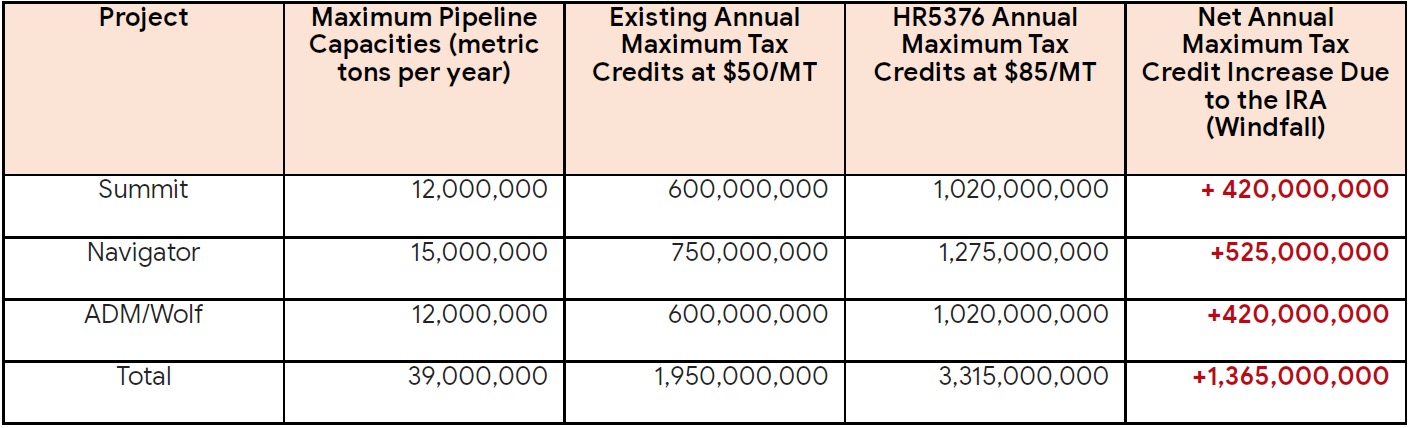

By way of example, the following table shows the annual maximum possible 45Q tax credits generated by the three carbon pipelines currently under development in the Midwest, both before and after the IRA’s boost of the 45Q credits by 70%, based on their claimed annual maximum pipeline capacities. It is important to understand that the developers of these pipelines considered these projects to be economically viable and profitable without the IRA’s proposed 70% increase.

The IRA would provide up to $1.365 billion dollars per year in windfall tax credits just for these three CCS projects. While these pipelines are unlikely to operate at full capacity at startup, such that the actual amounts of tax credits claimed at first might be, say, 2/3 of the rated capacity, the point here is that by providing a one-size-fits-all tax credit, the IRA amendments to the 45Q program would provide grossly excessive tax credits for low-cost CCS projects. Even if these CCS projects operate at 2/3 capacity, the IRA, at a minimum, would provide each of these CCS projects with hundreds of millions of dollars in tax credits per year above the levels necessary for construction and operation.

In contrast, the Canadian government is considering tax credits to cover 50% of CCS costs. This approach is similar to the U.S. IRA’s proposed Investment Tax Credit for solar that would cover just 30% of the costs of building solar plants solar costs. Taking all tax and depreciation benefits for solar projects into account, the U.S. federal government subsidizes about 44% of the capital costs of solar projects. The remainder of the cost of solar is ultimately paid for by sale of the electricity generated. A percentage approach at least avoids granting grossly excessive tax credits to lower-cost projects.

The $85/metric ton sequestration credit appears to provide tax credits in excess of 200% of the capital costs of CCS at ethanol plants, and possibly in excess of 150% of the costs of CCS at coal power plants. Since simply sequestering carbon does not generate cash, the 45Q tax credits must be high enough to pay for the entire cost of capture and sequestration projects. This being said, CCS projects may also receive cash from California’s low carbon fuel program or from selling CO2 to EOR projects, meaning that CCS projects might make earn money in addition to the tax credits.

So, who would receive these windfall tax credits? Only very large corporations and the super-rich have enough income to need huge amounts of tax credits. For example, investors in the Summit Carbon Solutions project include, but are not limited to, the Public Investment Fund of Saudi Arabia; SK holdings, a South Korean company fined over 70 million dollars for defrauding the US Army; and Harold Hamm of fracked oil fame. This list indicates that the three Midwestern CCS projects will primarily benefit major corporations and the global oligarchs, such as Senator Joe Manchin, because nobody but them needs such massive amounts of tax credits.

Why the IRA Could Revitalize the Coal Industry

Now, let’s consider how the IRA would impact the coal industry. To create example of potential tax credits available to the coal industry, I prepared a spreadsheet (attached) calculating examples of the maximum potential annual 45Q tax credits that could be claimed by 26 large Midwestern coal power plants (each with emissions of greater than 1 million metric tons of CO2 per year), if they installed carbon capture equipment and captured 100% of their 2020 emissions (emissions data from USEPA FLIGHT database). Again, it is unlikely that these coal power plants would capture 100% of emissions, and it would take years to develop CCS projects, but the estimates are intended to provide a sense of the scale of the financial benefits that could be provided to coal power plants and the potential for grossly excessive one-size-fits-all tax credit awards due to variations in carbon capture costs at different plants.

The estimates show that the maximum annual tax credits would range from $85 million to $1 billion, per year, per plant, depending on the size of the plant. Given the variable costs of carbon capture, the 45Q program could provide tax credits 18% to 113% above breakeven costs, or, depending on the size of the plant, roughly $13 million to $500 million per year, per plant, above breakeven. This analysis indicates that the IRA would make CCS economically viable at a large proportion of coal plants in the US and potentially provide tax benefits far in excess of CCS project costs, meaning the 45Q tax credit could directly subsidize the coal industry.

When Congress first created the 45Q program, it limited tax credits to just the first 75 million tons of carbon captured, and this cap limited the financial impact of the program. In 2018, Congress removed this cap, meaning that the 45Q program has no legal dollar limit. As a result of the elimination of this cap and the IRA’s 70% increase in tax credit amount, the majority of coal power plants nationwide might now be financially able to install CCS and collect tens if not hundreds of millions of dollars in tax credits per year, per plant. Yes, it would take years to install all of the necessary carbon capture equipment, but once projects are announced and operational and billions have been invested in capture facilities and pipelines, it would be very difficult if not impossible to shut them down – or shut down the coal plants that produce the captured carbon dioxide.

How Does the 45Q Program’s Size Compare to the Tax Credits That Would Be Provided to Wind and Solar?

Let’s compare the 45Q program’s potential financial benefits to those provided by the current wind energy production tax credit, based on a study by the Congressional Research Service entitled, The Renewable Electricity Production Tax Credit: In Brief, Updated April 29, 2020. Table 3 of this report on page 7 (pdf page 10) provides estimates of total nationwide federal renewable energy production tax credit expenditures, meaning the taxes lost due to PTC tax credit claims. Congress has estimated that the highest annual amount for total national PTC tax credit claims was $5.1 billion in 2019. Even considering that the IRA would provide enhanced PTC benefits, if the three Midwestern CCS projects start operations, they alone could be awarded tax credits worth up to $3.3 billion per year. If the 26 example coal plants captured 100% of their emissions, they would receive about $9.5 billion in tax credits. However, many more CCS projects are being planned.

The entire size of the “tax equity market,” meaning the total amount of tax credits claimed for renewable energy, affordable housing, etc., was estimated for 2020 to be between $17 and $18 billion dollars. Since Congress failed to impose a limit on the size of the 45Q program and all large CO2 emitters including coal power plants, natural gas power plants, oil refineries, natural gas processing plants, fertilizer plants, etc., may capture and claim 45Q credits, it seems likely that the IRA would result in the 45Q tax credit program growing in size to far exceed the renewable energy tax credit program.

Therefore, it would appear that IRA could provide potential tax benefits to facilities that emit carbon dioxide that could dwarf the benefits provided to renewable energy. Moreover, given the potential for windfall tax credits, there may be a risk that tax credit investors would prefer to invest in CCS projects over wind and solar projects, because the return on investment at CCS projects could be much higher.

Isn’t Carbon Capture and Sequestration Necessary to Stop Climate Change?

One of the primary arguments made by CCS advocates is that CCS is necessary to achieving net zero CO2 emissions by 2050, particularly from industries for which there are not good clean energy alternatives, such as steel production. The IRA’s supporters claim that it sets the carbon credit amount at $85/metric ton specifically to make CCS economic at such hard-nut-to-crack industries, but the IRA makes this high tax credit amount available to all CO2 emitting industries, regardless of the availability of clean energy alternatives or the carbon capture costs.

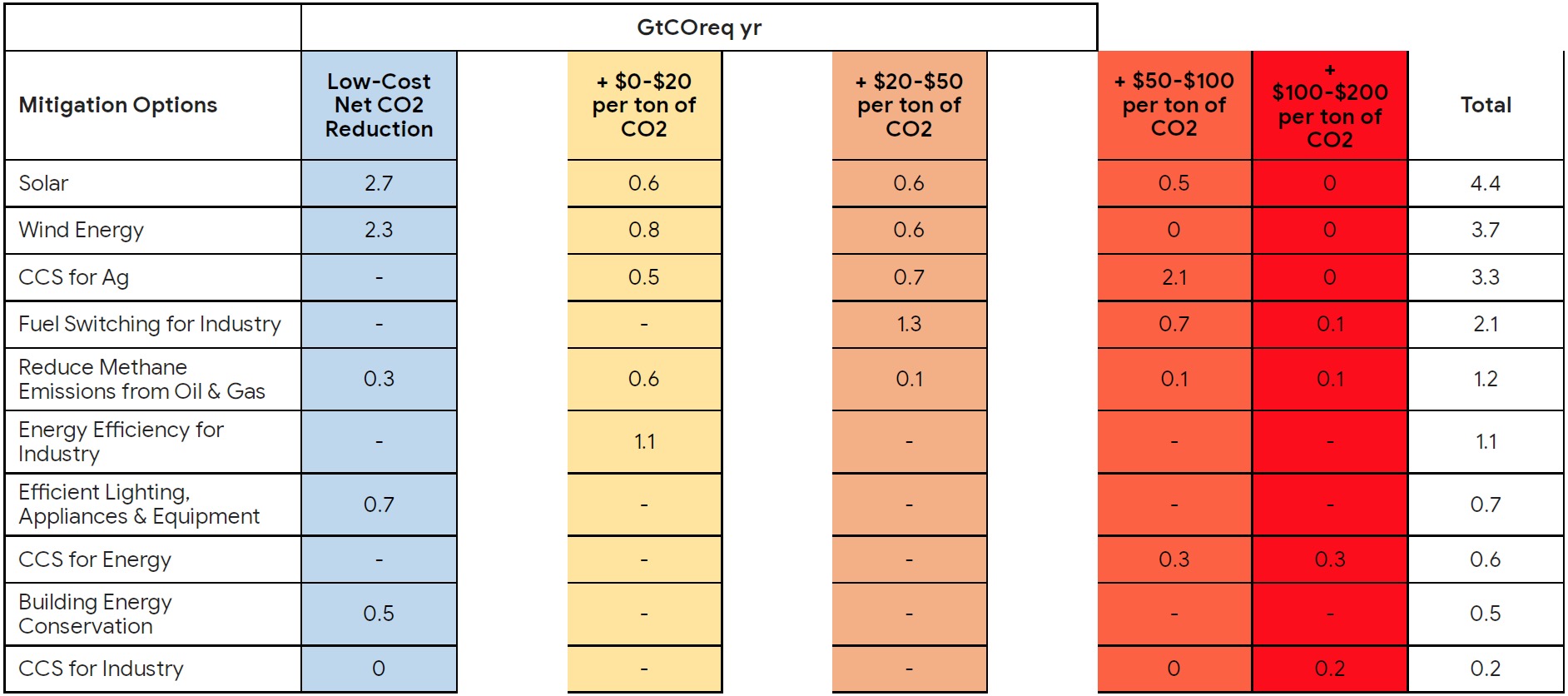

CCS advocates also claim that the IPCC states that CCS will be a “key” component of global CO2 emission reductions, but these advocates completely fail to consider that the order in time in which we fund carbon mitigation options and the relative costs of options are both critically important factors. We should fund the less expensive, higher bang-for-the-buck options first, before pouring cash into expensive CCS at “hard nut” industries. The following table excerpts data from Figure SMP7 (attached) from the April 2022 IPCC report. The data shows that CCS for energy and industry are among the most expensive mitigation options and that at most they would reduce global CO2 emissions by a relatively small amount, as compared to much lower cost clean energy, efficiency, conservation, and other options.

Select Climate Change Mitigation Option Amounts and Costs from IPCC 2022 Figure SPM.7

The IPCC data indicates that global climate change mitigation efforts should first spend money on renewable energy, energy efficiency, conservation, and a variety of other lower-cost options before seeking to crack the expensive “hard nut” industries via CCS. The justification for the 45Q program focuses on “hard nut” mitigation needs, which are the most expensive, least bang-for-the-buck mitigation options and should be lower priority. Even worse, the vast majority of the 45Q tax credits would almost certainly not be used to crack the “hard nuts,” but rather would be spent to continue operation of CO2 emitting industries that could be displaced by clean energy options. If the IRA is enacted, the oligarchs would likely first invest in CCS projects that provide windfall tax benefits, such as at ethanol and natural gas processing plants, before investing in expensive low-profit CCS projects at steel plants and other “hard nut” industries. The IPCC data indicates that CCS is not a key near-term climate mitigation solution, but rather should be funded after better mitigation options are fully exploited. The 45Q program is an example of spending a massive amount of money on the exact wrong thing.

Does the 45Q Tax Credit Program Deprioritize Enhanced Oil Recovery (EOR)?

Enhanced oil recovery (EOR) is a process whereby fluid CO2 is pumped underground to dissolve oil out of rock. It turns out the fluid CO2 is good at dissolving oil out of the rock pores in legacy oilfields, but huge amounts of it are needed for the EOR process to work. CO2 EOR can increase the amount of oil pumped from suitable legacy oilfields by 50% or more, which could result in a huge amount of additional crude oil being pumped and burned, both in the US and globally. Typically, the emissions from burning the oil exceed the amount of CO2 left in the ground after EOR operations end, often by a ratio of at least 2 tons of oil-based carbon to 1 ton of stored carbon.

Enhanced oil recovery (EOR) is a process whereby fluid CO2 is pumped underground to dissolve oil out of rock. It turns out the fluid CO2 is good at dissolving oil out of the rock pores in legacy oilfields, but huge amounts of it are needed for the EOR process to work. CO2 EOR can increase the amount of oil pumped from suitable legacy oilfields by 50% or more, which could result in a huge amount of additional crude oil being pumped and burned, both in the US and globally. Typically, the emissions from burning the oil exceed the amount of CO2 left in the ground after EOR operations end, often by a ratio of at least 2 tons of oil-based carbon to 1 ton of stored carbon.

Given that the 45Q tax credit program provides a tax credit worth $85/metric ton if the CO2 is simply sequestered underground, and just $60/metric ton if the CO2 is used in EOR, some might think that this means CCS projects would prioritize sending the CO2 to sequestration sites. However, the 45Q program actually creates an incentive to use the CO2 in EOR, because EOR operators are expected to pay a fee for the CO2 of approximately $25 to $40/metric ton that would be in addition to the tax credit. Thus, if a coal plant captured carbon and sold it to an EOR operation, it would receive $60/metric ton in federal tax credits plus $25 to $40/metric ton from the EOR operator. To beat out sequestration, EOR operators would just need to pay at least $25/ton or more for the CO2.

In the alternative, an oil company could simply own some or all of the carbon capture equipment at a coal plant, oil refinery, etc., and therefore own the right to decide where to ship its share of the CO2. Moreover, the oil company could snarf up any windfall tax credits generated by the CCS project and in effect subsidize the cost of the CO2, thereby increasing the profitability of its EOR operation.

The oil industry sees CO2 EOR as its next major development wave that will grow as fracking declines. The primary obstacle to increased development of CO2 EOR is not economics or technical challenges – it is a lack of access to huge amounts of liquid CO2. CO2 has been used in EOR for decades, but the EOR industry has primarily used natural underground CO2 deposits that are now pretty much fully exploited. The only way to make huge amounts of CO2 available to the EOR industry is to capture CO2 at industrial facilities and ship it to oilfields. The oil industry needs federally subsidized carbon capture projects to keep the oil flowing. This is why the CEO of Exxon recently described carbon capture the “holy grail” and called for the 45Q program tax credit to be increased to $100/metric ton. Carbon capture certainly is the holy grail for converting federal tax credits into future oil industry profits.

Bottom Line

The IRA is being rushed through Congress, yet it has the potential to provide truly massive subsidies and eyewatering windfall tax benefits to CO2 emitting industries. It’s not clear that those who are advocating for the IRA have adequately assessed the amount of potential tax credit benefits that an unlimited 45Q program could provide to CO2 emitters, especially when one considers that the coal, oil, and natural gas industries could all develop CCS projects and receive substantial financial benefits. Further, if tens or even hundreds of billions of dollars are spent to construct capture equipment and carbon pipelines, CO2 emitting industries would likely use these investments as arguments for why their CCS projects – and the facilities that emit the captured CO2 – should be kept in operation indefinitely. And, this would keep the federal gravy train rolling indefinitely.

The 45Q program is a means for CO2 emitters and their oligarch investors to claim to be reducing greenhouse gas emissions while simultaneously supporting the next wave of oil development and paying no taxes. By indiscriminately ramping up the 45Q program’s carbon credits by 70% across the board, the IRA threatens to hand out tens of billions of dollars in windfall tax credits to oligarchs and provide decades of public subsidies to all fossil fuel industries, while running roughshod over the local communities across America that would be subject to eminent domain for pipeline development. The IRA’s 45Q amendments are a remarkable example of Congressional corruption and inequity that supports the global rich at the cost of harming everyday Americans.